CENTERSPACE

3100 10th St SW

P.O. Box 1988

Minot, ND 58702-1988

April 4, 20229, 2024

Dear Fellow Shareholders:

It is a pleasure to invite you to attend the 52nd54th Annual Meeting of Shareholders (the “2022“2024 Annual Meeting”) of Centerspace (the(“we,” “us,” “our,” “Centerspace,” or the “Company”), to be held on Tuesday,Monday, May 17, 2022,20, 2024, at 9:12:00 a.m.p.m. Central Daylight Time via webcast. You will be able to attend the 20222024 Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting:visiting: www.virtualshareholdermeeting.com/CSR2022 CSR2024and entering the 16-digit16‐digit control number included in our noticeNotice of Internet Availability of the Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials.

At the 20222024 Annual Meeting, you will be asked to vote on the following items:

1.the election of seven nominees named in the Proxy Statement as trustees of the Company, each to serve for a term of one year expiring at the 2025 Annual Meeting of Shareholders or until his or her successor is duly elected and qualified;

2.an advisory vote on executive compensation (the “say-on-pay vote”);

3.the ratification of Grant Thornton LLP as our independent auditor for the year ending December 31, 2024; and

4.such other matters as may properly come before the 2024 Annual Meeting or any adjournment(s) or postponement(s) thereof.

The Board of Trustees recommends that you vote for each of these proposals.

Information about the 20222024 Annual Meeting and the formal business to be acted on by our shareholders is included in the Notice of Annual Meeting and the Proxy Statement that follow. Our 20222024 proxy materials and Annual Report for the year ended December 31, 20212023 are available online at www.proxyvote.com.www.proxyvote.com.

On or about April 4, 2022,9, 2024, we mailed most of our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on: (1) how to access our Proxy Statement and Annual Report via the Internet and (2) how to vote. The notice also included instructions on how to receive a paper copy of the proxy materials. On or about April 4, 2022,9, 2024, other shareholders, in accordance with their prior requests, were sent e-mail notifications containing instructions on how to access our proxy materials via the Internet and to vote or have been mailed paper copies of our proxy materials and a proxy card or voting form.

Please refer to the Proxy Statement for details on the 20222024 Annual Meeting, including detailed information on each of the proposals to be voted on at the meeting. Your shareholder vote is important, and I encourage you to vote promptly.

| |||

Sincerely,

Centerspace

Anne Olson

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on Tuesday,Monday, May 17, 2022,20, 2024, at 9:12:00 a.m.p.m. CDT

Notice is hereby given that the 20222024 Annual Meeting of Shareholders (the “2022“2024 Annual Meeting”) of Centerspace (the(“we,” “us,” “our,” “Centerspace,” or the “Company”), will be held on Tuesday,Monday, May 17, 2022,20, 2024, at 9:12:00 a.m. p.m.Central Daylight Time, via webcast, for the following purposes:

1.To elect seven nominees named in the Proxy Statement as trustees of the Company, each to serve for a term of one year expiring at the 2025 Annual Meeting of Shareholders or until his or her successor is duly elected and qualified;

2.To hold an advisory vote on executive compensation (the “say-on-pay vote”);

3.To ratify Grant Thornton LLP as our independent auditor for the year ending December 31, 2024; and

4.To transact such other business as may properly come before the 2024 Annual Meeting or any adjournment(s) or postponement(s) thereof.

These items are described in more detail in the Proxy Statement. We have not received notice of any other matters that may properly be presented at the 20222024 Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Company’s 2022our 2024 Annual Meeting to be held on May 17, 2022:20, 2024: The 20222024 Proxy Materials and Annual Report for the year ended December 31, 20212023 are available at www.proxyvote.com.www.proxyvote.com.

By Order of the Board of Trustees,  Anne Olson President, Chief Executive Officer and Secretary April 9, 2024 | |||

| |||

Minot, North Dakota

| It is important that your shares be represented and voted at the 2024 Annual Meeting. You can vote your shares by one of the following methods: (1) by Internet; (2) by telephone; (3) if you received your proxy materials by mail, by mailing your proxy card; or (4) virtually during the 2024 Annual Meeting. Any proxy may be revoked in the manner described in the Proxy Statement at any time prior to its exercise at the 2024 Annual Meeting. | ||

| Page | |||||||

| -i- | ||||||||

TABLE OF CONTENTS

(continued)

| Page | |||||||

A- | |||||||

ii

CENTERSPACE

3100 10th St SW

P.O. Box 1988

Minot, ND 58702-1988

Telephone: (701) 837-4738

Fax: (701) 838-7785

PROXY STATEMENT Q&A FOR 20222024 ANNUAL MEETING OF SHAREHOLDERS

The Board of Trustees (“Board”) of Centerspace, a North Dakota real estate investment trust (“we,” “us,” “our,” “Centerspace,” or the “Company”), is soliciting proxies to be used at the Annual Meeting of Shareholders of the Company to be held virtually on Tuesday,Monday, May 17, 202220, 2024 at 9:12:00 a.m.,p.m. Central Daylight Time, and any postponement(s) or adjournment(s) thereof (the “Annual Meeting”).

This proxy statement and the accompanying Notice and Form of Proxy are first being mailed or made available on the Internet to shareholders on or about April 4, 2022.9, 2024.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 20, 2024

Our Notice of Annual Meeting of Shareholders, the Proxy Statement, and our 2023 Annual Report are available on the following website: www.proxyvote.com.

In accordance with Securities and Exchange Commission (“SEC”) rules, we have elected to mail our proxy materials to the record holders of our common shares while also furnishing our proxy materials to shareholders over the Internet. We have instructed brokers, banks, and similar intermediary organizations to provide to the beneficial shareholders that hold their common shares in “street name” (other than beneficial shareholders who previously requested printed copy delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy materials online (the “Notice”).

If you receive the Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy materials. If you receive the Notice by mail and would like to receive a copy of our proxy materials, follow the instructions contained in the Notice about how you may request to receive a copy electronically or in printed form free of charge on a one-time or ongoing basis. We encourage shareholders to take advantage of the availability of the proxy materials on the Internet as we believe electronic delivery will expedite the receipt of materials while lowering costs and reducing the environmental impact of our Annual Meeting by reducing printing and mailing of materials.

In addition to this proxy statement, our proxy materials include our 2023 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”). Copies of the Form 10-K, as well as other periodic filings by the Company with the SEC, also are available in the Investor Relations section of our website (ir.centerspacehomes.com) under the tab “Financial Reporting.” The information included in our website is not incorporated herein by reference.

QUESTIONS AND ANSWERS ABOUT

THE PROXY MATERIALS AND THE ANNUAL MEETING

How is the Company distributing proxy materials?

We will be hosting the 20222024 Annual Meeting live via the Internet. Shareholders will be able to participate in the 20222024 Annual Meeting online via live webcast. Provided below is the summary of the information that you will need to participate in the 20222024 Annual Meeting.

•Shareholders can participate in the 20222024 Annual Meeting via live webcast over the Internet at www.virtualshareholdermeeting.com/CSR2022.CSR2024.

1

•The 20222024 Annual Meeting webcast begins at 9:12:00 a.m.p.m., Central Daylight Time. On the day of the Annual Meeting, we recommend that you log into our virtual meeting at least 15 minutes prior to the scheduled start time to ensure that you can access the meeting.

•You will need your 16 16‐digit control number included in our noticeNotice of Internet availabilityAvailability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials, to enter the 20222024 Annual Meeting.

•You may submit questions for the meeting in advance at www.proxyvote.com.www.proxyvote.com. Shareholders will also have the ability to vote and submit live questions during the Annual Meeting webcast at www.virtualshareholdermeeting.com/CSR2022.CSR2024. Questions related directly to the 20222024 Annual Meeting will be answered during our virtual meeting, subject to time constraints. AnyCertain questions pertinentingpertinent to meeting matters that cannot be answered during the meeting due to time constraints will be available in the Investor Relations section of our website (ir.centerspacehomes.com). The questions and answers will be available as soon as practical after the meeting and will remain available until one week after the posting.

•Instructions on how to attend and participate in the live webcast, including how to verify stockshare ownership and vote your shares electronically during the 20222024 Annual Meeting, are available at www.virtualshareholdermeeting.com/CSR2022.CSR2024.

•Webcast replay of the 20222024 Annual Meeting will be available on our website (ir.centerspacehomes.com) as soon as practicable following the meeting.

What proposals will be voted on at the Annual Meeting?

We anticipate the following three proposals will be voted on at the Annual Meeting:

•The election of eightseven trustees to serve until the 20232025 annual meeting of shareholders or until their respective successors are duly elected and qualified;

•The approval on a non-binding advisory basis of the compensation paid to the Company’sour named executive officers; and

•The ratification of the appointment of Grant Thornton LLP as the Company’sour independent registered public accounting firm for the year ending December 31, 2022.2024.

What are the Board’s recommendations?

Our Board unanimously recommends that you vote:

•“FOR” the election of eightseven trustees to serve until the next annual meeting of shareholders or until their respective successors are duly elected and qualified (Proposal 1);

•“FOR” the non-binding advisory approval of executive compensation (Proposal 2); and

•“FOR” the ratification of the appointment of Grant Thornton LLP as the Company’sour independent registered public accounting firm for the year ending December 31, 20222024 (Proposal 3).

What happens if additional matters are presented at the Annual Meeting?

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxy holders, Mark O. Decker, Jr.Anne Olson or Anne Olson,Bhairav Patel, will have discretion to vote on those matters in accordance with his, her or their best judgment. We do not currently anticipate that any other matters will be raised at the Annual Meeting.

2

Who is entitled to vote?

Shareholders of record at the close of business on March 22, 202225, 2024 (the “Record Date”) may vote at the Annual Meeting. As of the close of business on the Record Date, there were 15,355,50614,888,553 of our common shares outstanding. Each common share is entitled to one vote on all matters being considered at the Annual Meeting.

What constitutes a quorum?

The presence at the Annual Meeting, virtually or by proxy, of the holders of thirty-three and one-third percent (33 1/3%) of all the votes entitled to be cast at the Annual Meeting on any matter will constitute a quorum. Both abstentions and broker non-votes (as discussed below under “What vote is required to approve each item?”) are counted for the purpose of determining the presence of a quorum.

What is the difference between holding shares as a registered shareholder and holding shares in street name?

If your common shares are owned directly in your name with our transfer agent, American Stock Transfer &Equiniti Trust Company LLC (“AST”Equiniti”), you are considered a registered holder of those common shares.

If your common shares are held by a broker, bank, or nominee, you hold those common shares in street name. Your broker, bank, or other nominee will vote your common shares as you direct.

How do I vote?

Whether you hold shares as the shareholder of record or in street name, you may direct how your shares are voted without virtually attending the Annual Meeting. Even if you plan to virtually attend the Annual Meeting, we encourage you to vote in advance of the meeting in order to ensure that your vote is counted.

Shareholders of Record.As a shareholder of record, you may vote during the Annual Meeting webcast by visiting www.virtualshareholdermeeting.com/CSR2022 CSR2024and entering the 16-digit16‐digit control number included in our noticeNotice of Internet availabilityAvailability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials. Alternatively, you may vote by authorizing a proxy by completing, signing, and dating a proxy card and mailing it in the accompanying pre-addressed envelope in accordance with the instructions included on your proxy card.

Beneficial (“Street Name”) Shareholders. Shareholders. The broker, bank, or similar intermediary that holds your common shares in an account is considered to be the holder of record for purposes of voting at the meeting. As a beneficial owner, you have the right to direct the intermediary how to vote the common shares held in your account. You may vote by submitting voting instructions to your broker, bank, trustee, or other intermediary in accordance with the Notice, including by submitting a voting form provided to you by such intermediary. Alternatively, you may vote during the Annual Meeting webcast by visiting www.virtualshareholdermeeting.com/CSR2022CSR2024 and entering the 16-digitthe16‐digit control number included in our noticeNotice of Internet availabilityAvailability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials. You can ensure your vote is cast at the meeting by completing, signing, dating, and returning your proxy card or voting form. Your vote will be cast in accordance with the instructions included on a properly signed and dated proxy card or voting form.

If you do not return a signed proxy card or voting form (or, if you are a beneficial owner, otherwise submit your vote in accordance with the instructions provided in the Notice) or virtually attend the Annual Meeting and vote, no vote will be cast on your behalf. The proxy card indicates on its face the number of common shares registered in your name on the Record Date, which corresponds to the number of votes you will be entitled to cast at the meeting on each proposal.

You are urged to follow the instructions on your proxy card or your Notice and voting form, as applicable, to indicate how your vote is to be cast. If you return your signed proxy but do not indicate your voting preferences, your common shares will be voted on your behalf as follows:

•“FOR” the election of eightseven trustees to serve until the next annual meeting of shareholders or until their respective successors are duly elected and qualified (Proposal 1);

3

•“FOR” the non-binding advisory approval of executive compensation (Proposal 2); and

•“FOR” the ratification of the appointment of Grant Thornton LLP as the Company’sour independent registered public accounting firm for the year ending December 31, 20222024 (Proposal 3).

Can I change my vote or revoke my proxy?

If you are a shareholder of record, you may revoke your proxy at any time prior to the vote at the Annual Meeting. If you submitted your proxy by mail, you must file with the Secretary of the Company a written notice of revocation or deliver, prior to the vote at the Annual Meeting, a valid, later-dated proxy. Virtually attending the Annual Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Secretary before the proxy is exercised or vote during the Annual Meeting webcast by visiting www.virtualshareholdermeeting.com/CSR2022CSR2024 and entering the 16-digit16‐digit control number included in our noticeNotice of Internet availabilityAvailability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials.

If you are a beneficial owner, you may change your vote by submitting new voting instructions (including a voting form) to your broker, bank or nominee, or vote during the Annual Meeting webcast by visiting www.virtualshareholdermeeting.com/CSR2022CSR2024 and entering the 16-digit16‐digit control number included in our noticeNotice of Internet availabilityAvailability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials.

What vote is required to approve each item?

| Proposal | Voting Options | Vote Required to Adopt the Proposal | Effect of Abstentions | Effect of Broker Non-Votes(1) | |||||||||||||||||||||||||||

1.Election of Trustees | For, against or abstain on each nominee | The affirmative vote of a majority of the voting power of the shareholders present in person or by proxy | Same as Against Vote | No effect | |||||||||||||||||||||||||||

2.Advisory vote to approve | For, against or abstain | The affirmative vote of a majority of the voting power of the shareholders present in person or by proxy | Same as Against Vote | No effect | |||||||||||||||||||||||||||

For, against or abstain | The affirmative vote of a majority of the voting power of the shareholders present in person or by proxy | Same as Against Vote | |||||||||||||||||||||||||||||

(1)If you hold your shares in street name and do not provide voting instructions to the broker, bank or other nominee that holds your shares, the nominee has discretionary authority to vote on Proposal No. 3, but not for any of the other proposals.

If your common shares are held in street name, and you do not instruct the broker as to how to vote these shares on Proposal 1or1 or 2, the broker may not exercise discretion to vote for or against those proposals. This would be a “broker non-vote,” and these shares will not be counted as having been voted on the applicable proposal. With respect to Proposal 3, the broker may exercise its discretion to vote for or against that proposal in the absence of your instruction. Please instruct your bank or broker so your vote can be counted.

Is cumulative voting permitted for the election of trustees?

No. The Company’sOur Declaration of Trust and Bylaws do not permit cumulative voting at any election of trustees.

4

How are proxies solicited?

Trustees, officers, and employees of the Company may, without additional compensation, solicit proxies by mail, email and/or telephone. We will pay the cost of this proxy solicitation. In addition, we will, upon request, reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to the beneficial owners of common shares.

What is householding?

The SEC has adopted rules that allow a company to deliver a single notice or set of proxy materials to an address shared by two or more of its shareholders. This method of delivery, known as “householding,” permits us to realize cost savings and reduces the amount of duplicate information shareholders receive. For notices sent to shareholders sharing a single address, we are sending only one set of proxy materials (or one Notice, if applicable) to that address unless we have received contrary instructions from a shareholder at that address. Any shareholders who object to, or wish to begin, householding or who wish to receive just one set of materials (rather than multiple copies) in the future may notify the Secretary orally or in writing at the telephone number or address set forth herein. We will deliver promptly an individual copy of the proxy materials (or one Notice, if applicable) to any shareholder who revokes its consent to householding upon our receipt of such revocation.

How do I find out the voting results?

We will announce preliminary voting results at the Annual Meeting. We will disclose the final voting results in a Current Report on Form 8-K to be filed with the SEC on or before May 20, 2022.23, 2024. The Form 8-K will be available

at our website (ir.centerspacehomes.com) under the tab “Financial Reporting — SEC Filings” and on the SEC’s website at http://www.sec.gov.

What do I need to do if I would like to attend the Annual Meeting?

You will be able to attend the 20222024 Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/CSR2022CSR2024 and entering the 16-digit16‐digit control number included in our noticeNotice of Internet availabilityAvailability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials.

What is the deadline for shareholder proposals for the 20232025 Annual Meeting?

The deadline for submitting a shareholder proposal for inclusion in the proxy materials to be distributed by the Company in connection with the 20232025 Annual Meeting of Shareholders pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is December 5, 202210, 2024 (120 days prior to the anniversary of the mailing date of this Proxy Statement). Such proposals must comply with SEC regulations under Rule 14a-8 of the Exchange Act regarding the inclusion of shareholder proposals in company-sponsored proxy materials.

In addition, our Bylaws contain additional advance notice requirements for shareholders who wish to present a proposal, including shareholder nominees for election to the Board, before an annual meeting of shareholders (and not pursuant to Rule 14a-8 of the Exchange Act). According to our Bylaws, nominations of individuals for election to our Board at an annual meeting and the proposal of other business to be considered by shareholders must be made not less than 90 days norand no more than 120 days prior to the first anniversary of the preceding year’s annual meeting. As a result, any notice given by or on behalf of a shareholder pursuant to these Bylaw provisions (and not pursuant to Rule 14a-8 of the Exchange Act) must be received no earlier than January 17, 202320, 2025 and no later than February 16, 2023.19, 2025. A shareholder’s notice must set forth the information required by our Bylaws with respect to each shareholder proposal.

All notices of proposals by shareholders, whether or not intended to be included in the Company’sour proxy materials, should be sent to Centerspace, c/o Secretary, 3100 10th St SW, P.O. Box 1988, Minot, ND, 58702-1988.

5

Description of Proposal

The Articles of Amendment and Third Restated Declaration of Trust of the Company, as amended (the “Declaration of Trust”) provide that the Board of Trustees will be composed of not less than five norand no more than fifteen trustees. The Board currently consists of eight trustees. On January 18, 2022, Rodney Jones-Tyson23, 2024, Ola Oyinsan Hixon was appointed as an Independent Trustee by the Board of Trustees of Centerspace. The Board has determined that Mr. Jones-TysonMs. Hixon is independent for purposes of serving on the Board under the applicable rules of the Securities and Exchange Commission and the New York Stock Exchange.

Linda Hall has completed 12 full years of service and therefore, pursuant to the director term limits provided for in our Corporate Governance Guidelines, Ms. Hall will not be nominated for re-election at the 2024 Annual Meeting. The Board determined that, upon the conclusion of Ms. Hall’s term, the size of the Board shall decrease to seven trustees.

John A. Schissel, Jeffrey P. Caira, Michael T. Dance, Mark O. Decker, Jr., Emily Nagle Green, Linda J. Hall,Ola Oyinsan Hixon, Rodney Jones-Tyson, Anne Olson and Mary J. Twinem have been nominated for election as trustees at the Annual Meeting, to serve for a term of one year expiring at the 20232025 Annual Meeting of Shareholders or until their successors are duly elected and qualified.

All of the nominees are presently serving as trustees of the Board and were recommended for nomination for re-election by the Nominating and Governance Committee of the Board, and such recommendations were adopted by the Board.

In the unanticipated event that any nominee should become unavailable for election, either the persons named as proxies on the proxy card will have discretionary authority to vote pursuant to the proxy card for a substitute nominee nominated by the Board, or the Board, on the recommendation of the Nominating and Governance Committee, may reduce the size of the Board and number of nominees.

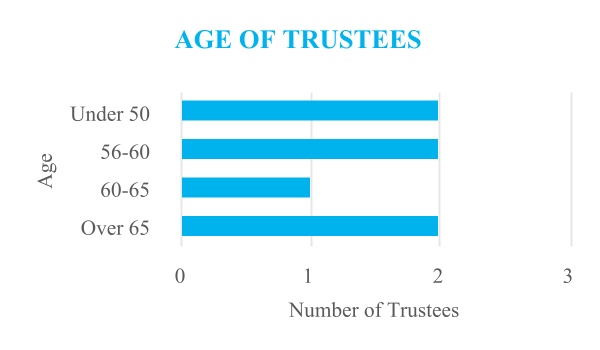

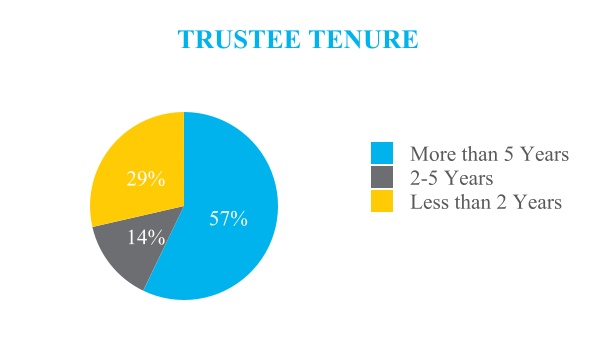

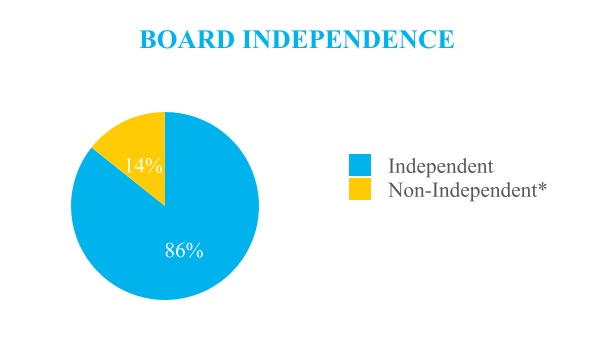

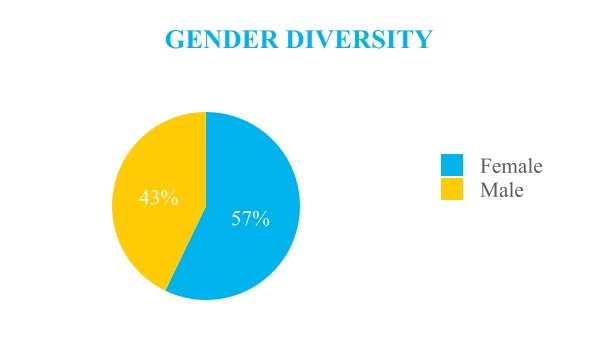

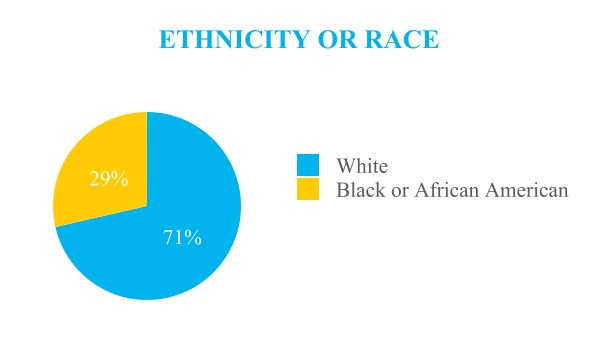

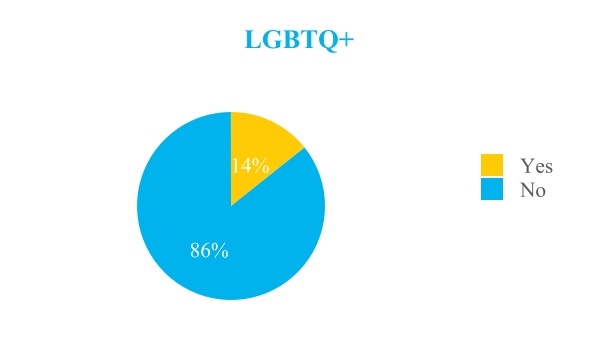

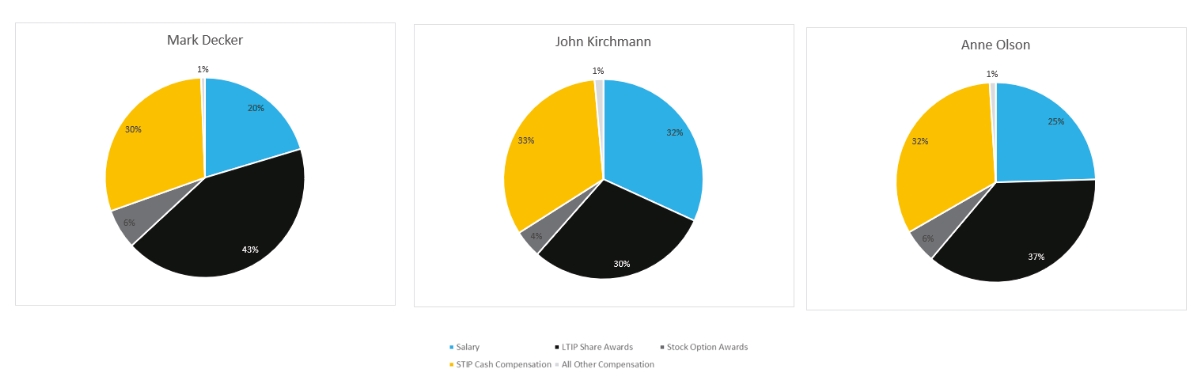

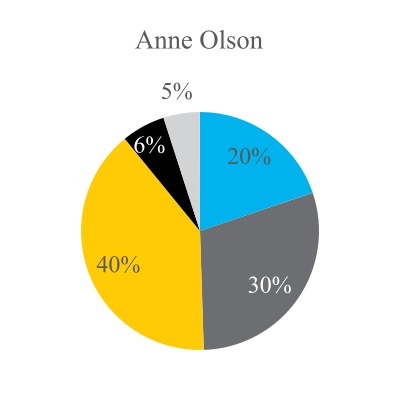

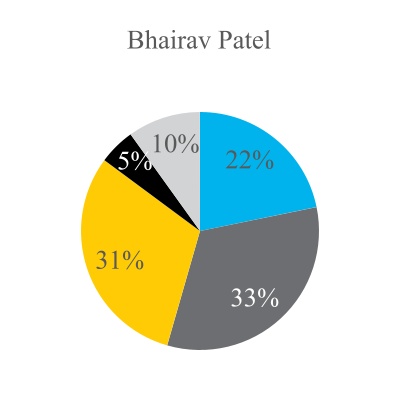

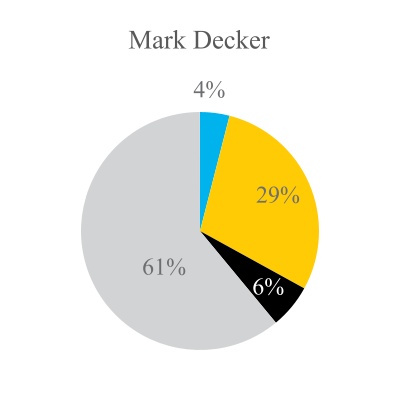

The charts below provide additional information regarding the proposed composition of our Board considering the nominees, including age of our trustees, trustee tenure, gender diversity, and Board independence:

*Chief Executive Officer

6

Required Vote

The affirmative vote of the holders of a majority of the common shares present in person or by proxy at the Annual Meeting, provided a quorum is present, is required to elect each of the eightseven trustee nominees.

Vote Recommended

The Board recommends that shareholders vote FOR the election of the eightseven nominees named in the Proxy Statement as trustees of the Company, each to serve for a term of one year expiring at the 20232025 Annual Meeting of Shareholders or until his or her successor is duly elected and qualified.

Nominees

The following table sets forth, as of March 25, 2024, the names of and biographical information regarding each of the nominees, including their age, as of March 22, 2022, principal occupation, the year they each first became a trustee, their current Board committee memberships and the experience, qualifications, attributes and skills that have led the Board to conclude that they should serve as a trustee of the Company.

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

John A. Schissel Chair | | | President and Director for Carr Properties, a privately held REIT John A. Schissel has served as trustee of the Company since April 19, 2016 and was appointed as Chairman effective December 9, 2021. He has over 30 years of experience collectively in the capital markets and as an executive for both public and private real estate company platforms. Mr. Schissel currently serves as the President of Carr Properties and is a member of Carr’s Board of Directors. Carr Properties is a privately held REIT focused on the ownership, development, acquisition and management of best-in-class office properties in the Washington, DC, Boston, Massachusetts and Austin, Texas markets. In his role he oversees the Company’s Financial, Human Resource, Operations, Technology, Brand and Hospitality functions. Mr. Schissel served as the Executive Vice President and Chief Financial Officer of Invitation Homes, the nation’s largest owner and operator of single-family rental homes from 2014 to 2015 and Executive Vice President and Chief Financial Officer of BRE Properties, Inc., a NYSE listed multifamily REIT based on the West Coast, from 2009 to 2014. His career experience also includes serving in Wachovia Securities’ Real Estate Investment Banking Group. He received his Bachelor of Science degree in Business Administration with a concentration in finance from Georgetown University. Mr. Schissel brings the following experience, qualifications, attributes and skills to the Board: corporate finance, capital markets, investment banking, executive management, and strategic planning experience; public company executive management, accounting, and reporting experience from serving as CFO of two publicly-traded REITs; real estate industry investment, development and management experience from his over 30 years in the real estate industry; and his extensive business and personal contacts in the real estate industry. | | | 55 | | | 2016 | | | Independent Chair of the Board of Trustees |

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

Jeffery P. Caira | | | Former Director — Co-Portfolio Manager with AEW Capital Management Jeffrey P. Caira has served as a trustee of the Company since June 23, 2015, is currently Chair of the Nominating and Governance Committee and a member of the Audit Committee. He served as Chair of the Board from April 2017 to December 2021. Mr. Caira has over 38 years of experience in the real estate industry. From 2003 to 2013, he served in various positions at AEW Capital Management, lastly as Director-Co-Portfolio Manager of the North American Diversified Strategy, a multi-billion dollar real estate securities portfolio, before retiring. Prior to that, Mr. Caira served as a Vice President-Portfolio Manager and Senior Analyst for Pioneer Investment Management, Inc. from 2000 to 2003, managing the U.S. real estate sector fund; and Vice-President — Senior Equity Research Analyst for RBC Dain Rauscher, Inc. (formerly Tucker Anthony) from 1998 to 2000, covering equity REITs. Mr. Caira graduated from the University of Notre Dame with a BBA and holds an MBA from the Kellogg School of Management. He is a licensed real estate broker in the Commonwealth of Massachusetts. Mr. Caira brings the following experience, qualifications, attributes, and skills to the Board: general business management, portfolio management, portfolio valuation and analysis of public securities and real estate, capital markets, investment banking, finance, strategic planning, property management and property acquisition experience from his over 38 years in the real estate industry; insight into governance and management best practices from over 15 years of serving on boards of various non-profit organizations; and extensive business and personal contacts in the real estate and investment banking fields. | | | 64 | | | 2015 | | | Independent Trustee; Audit; Nominating and Governance (Chair) |

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

Michael T. Dance | | | Former Chief Financial Officer of Essex Property Trust, Inc. (NYSE: ESS) Michael T. Dance has served as a trustee of the Company since April 19, 2016. Mr. Dance has over 23 years of real estate industry experience and over 35 years of accounting and finance experience. From 2005 until he retired in late 2015, Mr. Dance served as Executive Vice President and Chief Financial Officer of Essex Property Trust, Inc., an S&P 500 company and publicly traded REIT that acquires, develops, redevelops, and manages multifamily residential properties in select West Coast markets. From 2002 to 2005, Mr. Dance was an independent consultant providing Sarbanes-Oxley compliance consultation and litigation support and served as an adjunct Professor for the University of California at Berkeley, Haas School of Business. Mr. Dance began his career at KPMG in 1978 and was a partner from 1990 to 2002. Mr. Dance received his Bachelor’s degree in Economics from California State University, East Bay, and is a Certified Public Accountant (retired). Mr. Dance brings the following experience, qualifications, attributes and skills to the Board: general business management, corporate governance and finance and strategic planning experience from his executive-level position with a publicly traded REIT; real estate industry investment, development, acquisition, disposition, marketing, and management experience from his over 23 years in the real estate industry; accounting and public reporting experience; and extensive business and personal contacts in the real estate industry. | | | 65 | | | 2016 | | | Independent Trustee; Audit, Compensation |

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

Mark O. Decker. Jr. | | | President, Chief Executive Officer, and Chief Investment Officer of the Company Independent Director of Alpine Income Property Trust, Inc. (NYSE: PINE) Mark O. Decker, Jr. has served as a trustee of the Company since April 27, 2017 and has been employed by the Company since August 5, 2016. Mr. Decker has been the Company’s President and Chief Investment Officer since August 5, 2016 and was appointed as the Company’s Chief Executive Officer on April 27, 2017. For the two decades prior to joining Centerspace, Mr. Decker was an investment banker and spent the majority of that time serving the real estate industry as a senior banker at several firms with a focus on growth and transformational transactions for public real estate owner/operators, lodging companies and real estate services firms. Immediately prior to joining our company Mr. Decker served as the Managing Director and U.S. Group Head of Real Estate Investment and Corporate Banking at BMO Capital Markets. Mr. Decker received a Bachelor’s degree in History from the College of William & Mary. In addition, Mr. Decker is a Trustee for Alpine Income Property Trust (NYSE:PINE) and is actively involved with several industry groups including the National Multifamily Housing Council, Urban Land Institute, and Nareit. Mr. Decker brings the following experience, qualifications, attributes and skills to the Board: capital markets and strategic planning experience from his 16-year career as a real estate investment banker; familiarity with the various real estate markets in which the Company operates through his service as an executive with the Company; and extensive contacts through his years in the real estate and finance industries. | | | 46 | | | 2017 | | | Executive Trustee; None |

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

Emily Nagle Green | | | Former CEO of Smart Lunches, Inc. Independent Director of Casella Waste Systems (NASDAQ: CWST) and Vuzix Corporation (NASD: VUZI) Emily Nagle Green has served as a trustee of the Company since February 15, 2018. Ms. Green has a wealth of experience leading companies that have developed innovative technologies for businesses and consumers alike. Currently, she is an independent director for Casella Waste Systems, where she chairs its Nominating & ESG Committee, and Vuzix Corporation, where she serves as the chair of the Compensation Committee. She has served as CEO of three different companies, including Smart Lunches, Inc., a venture-backed start-up providing online ordering and delivery for school lunches, for which she served as CEO from 2012-2016 and raised four rounds of capital, helped to build an award-winning technology platform, and scaled the business to serve 300 schools in 9 states. Prior to that, she served as CEO for two private- equity-backed research firms from 2005-2011: Yankee Group and Cambridge Energy Research Associates (CERA). She also led consumer technology research at Forrester Research, Inc., where she built the then-largest consumer technology research panel, serving executives at dozens of Fortune 1000 firms seeking to meet consumer needs in a fast-changing technology environment. She also coaches first-time CEOs and is the author of “ANYWHERE: How Global Connectivity is Revolutionizing the Way We Do Business” (McGraw-Hill 2010). Ms. Green received a Bachelor’s degree in linguistics from Georgetown University and a Master’s degree in Artificial Intelligence and Computer Graphics from the University of Pennsylvania. Ms. Green brings the following experience, qualifications, attributes and skills to the Board: executive leadership and management, general business management, application of technology, corporate governance, strategic planning experience from serving as CEO of three companies, and management best practices from her years of advising CEOs and boards of various companies and non-profit organizations. | | | 64 | | | 2018 | | | Independent Trustee; Nominating and Governance; Compensation |

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

Linda J. Hall | | | Entrepreneur-in-Residence, Carlson School of Management, University of Minnesota Independent Director of DentaQuest and Martell Diagnostic Laboratories Linda J. Hall, Ph.D., has served as a trustee of the Company since September 21, 2011. Since 2008, Ms. Hall has been a volunteer Entrepreneur-in-Residence at the Carlson School of Management, University of Minnesota. Ms. Hall has more than 40 years of executive experience in the manufacturing and service sectors, including healthcare, venture capital financing, employee benefits, and teaching. During her career, she has launched 20 start-up companies as an executive, director, or consultant, including three $1 billion plus companies. Ms. Hall also has 25 years of experience serving on the boards of privately-held and public reporting companies in the United States and Europe, including serving as the chair of compensation, compliance, governance, and nominating committees and as a member of audit committees. Ms. Hall currently serves on the board of directors of DentaQuest and Martell Diagnostic Laboratories, the advisory boards for Surly Brewing Company and the Glen Nelson Center (American Public Media) and the not-for-profit boards of Children’s Minnesota, and the Youth Mental Health Project. She previously served on the boards of four publicly held companies: Amedisys (NASDAQ: AMED) from 2013 to 2019, Health Fitness Corporation (NASDAQ: HFIT) from 2001 until it was acquired in 2010, MTS Systems Corporation (NASDAQ: MTS) from 1995 to 2006, and August Technology (NASDAQ: AUGT) from 2002 until it was acquired in 2006. She also served on the Ascension Ventures board from 2011 to 2018, and previously served on the board of a privately-held European company, Laastari/ R Clinic, from 2010 to 2015. She is a Phi Beta Kappa graduate of the University of Michigan and received a master’s degree in Psychology from the University of Michigan, a master’s degree in Social Work from the University of Minnesota, and a Ph.D. in Education Administration from the University of Minnesota. Ms. Hall brings the following experience, qualifications, attributes and skills to the Board: general business management, marketing strategy and strategic planning experience from her executive-level positions with public and private companies, and extensive experience with corporate governance and compensation practices from her service on numerous non-profit, private, and public company boards of directors. | | | 72 | | | 2011 | | | Independent Trustee; Compensation (Chair); Nominating and Governance, |

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

Rodney Jones-Tyson | | | Global Chief Human Resource Officer for Robert W. Baird & Co., a privately held firm Mr. Jones-Tyson has over 30 years of experience working for global financial services companies. Mr. Jones-Tyson is currently the Global Chief Human Resources Officer for Baird, a privately-held, employee-owned wealth management, asset management, investment banking/capital markets and private equity firm with offices in the United States, Europe and Asia. Prior to his current position, Mr. Jones-Tyson was Baird’s Chief Risk Officer from 2018-2021, the Chief Operating Officer for Baird’s Global Investment Banking Group from 2011-2018 and the Director of Business Development for Baird from 2008-2011. Mr. Jones-Tyson began his career at Baird in 1998 as an investment banker where he provided mergers and acquisitions and equity capital markets advice to mid-market companies in the US and Europe. Prior to joining Baird, Mr. Jones-Tyson was in the corporate lending group at Chase Manhattan Bank and the consumer lending division of Chase Manhattan Bank and Citibank. Mr. Jones-Tyson received his MBA from the University of Chicago Booth School of Business and earned a Bachelor’s degree in Finance from the University of Maryland College Park. Mr. Jones-Tyson brings the following experience, qualifications, attributes and skills to the Board: Over 30 years of experience in the financial services industry. | | | 53 | | | 2022 | | | Independent Trustee |

Nominee | | | Principal Occupation and Summary Biography | | | Age | | | Trustee Since | | | Independence and Board Committee Membership |

Mary J. Twinem | | | Former Executive Vice President and Chief Financial Officer of Buffalo Wild Wings, Inc. Independent director of Valvoline, Inc. (NYSE: VVV) and Medica Holding Company, a multi- state health insurance company. Mary J. Twinem has served as a trustee of the Company since February 15, 2018. Ms. Twinem retired in 2016 after two decades as the Executive Vice President and Chief Financial Officer for Buffalo Wild Wings, Inc. Ms. Twinem managed the functional areas of Financial Reporting, Financial Planning and Analysis, Information Systems, Investor Relations, Supply Chain and Philanthropy for Buffalo Wild Wings and its over 1,100 company- owned and franchised Buffalo Wild Wings, PizzaRev, and R Taco restaurants in the United States and 4 countries worldwide. Ms. Twinem has over 30 years of experience in accounting, financial reporting, and income tax preparation, including seven years in public accounting where she assisted primarily small businesses. From 1989 to 1994, she worked for Dahlberg/Miracle-Ear, the manufacturer and franchisor of Miracle-Ear hearing aids, ultimately becoming the company's Controller. In 1995, Twinem joined Buffalo Wild Wings as Controller and was promoted to Chief Financial Officer in 1996. In Twinem’ s over 20 years with Buffalo Wild Wings, she established the financial framework to grow the company from 35 to over 1,100 restaurants, with system-wide revenue of $3.8 billion in 2016. She was instrumental in securing both debt and private equity financings, ultimately leading the company through one of the most successful Initial Public Offerings of 2003. Ms. Twinem was named one of the “Top Women in Finance” in Minnesota by the Finance and Commerce publication in 2004 and inducted into their Circle of Excellence in 2010, and was a 2009 finalist for “CFO of the Year” by Minneapolis-St. Paul Business Journal. Ms. Twinem received a B.S. in Accounting from the University of Wisconsin-Platteville in 1982 and became a Certified Public Accountant in 1984. She serves on the board of directors of Medica Holdings Company, the non-profit family of companies that | | | 61 | | | 2018 | | | Independent Trustee; Audit (Chair); Compensation |

John A. Schissel Chair | Director of Carr Properties, a privately held real estate investment trust that owns, manages, acquires, and develops premium-quality commercial properties in Washington, DC, Boston, Massachusetts, and Austin, Texas. | was appointed Chairman effective December 9, 2021. •Over 30 years collectively in the real estate and REIT sectors both as an executive for both publicly traded and private-equity owned real estate companies and as a banker. This includes significant strategic, capital markets, operational and investment experience at the executive leadership level. •Previously, served as Executive Vice President and Chief Financial Officer at Carr Properties’ predecessor, Columbia Equity Trust, from 2004 to 2009, which included its 2005 NYSE-listed initial public offering and subsequent sale to an affiliate of JP Morgan Asset Management in 2007. Prior to his time at Columbia Equity Trust, served as a commercial and investment banker at Wachovia Bank and predecessor entities from 1991 to 2004. •Received his Bachelor of Science degree in Business Administration with a concentration in finance from Georgetown University. | ||||||||||||||

| Age: 57 | ||||||||||||||||

| Trustee since 2016 | ||||||||||||||||

| Independent Trustee | ||||||||||||||||

Committees: Chair of the Board of Trustees | ||||||||||||||||

7

Jeffrey P. Caira | •Former Director - Co-Portfolio Manager with AEW Capital Management. •Served as a trustee of the Company since June 23, 2015, is currently Chair of the Nominating and Governance Committee and a member of the Audit Committee; was Chair of the Board from April 2017 to December 2021. •Over 40 years of experience in the real estate industry. From 2003 to 2013, he served in various positions at AEW Capital Management, lastly as Director - Co-Portfolio Manager of the North American Diversified Strategy, a multi-billion dollar real estate securities portfolio, before retiring. •Served as a Vice President-Portfolio Manager and Senior Analyst for Pioneer Investment Management, Inc. from 2000 to 2003, managing the U.S. real estate sector fund; and Vice-President - Senior Equity Research Analyst for RBC Dain Rauscher, Inc. (formerly Tucker Anthony) from 1998 to 2000, covering equity REITs. •Mr. Caira graduated from the University of Notre Dame with a BBA and holds an MBA from the Kellogg School of Management; he is a licensed real estate broker in the Commonwealth of Massachusetts. | ||||

| Age: 66 | |||||

| Trustee since 2015 | |||||

| Independent Trustee | |||||

Committees: Audit; Nominating and Governance (Chair) | |||||

Emily Nagle Green | •Independent Director of Casella Waste Systems (NASDAQ: CWST) and Vuzix Corporation (NASD: VUZI). •Served as a trustee of the Company since February 15, 2018 and is a member of the Nominating and Governance and Audit Committees. •Currently serves as chair of the Nominating & ESG Committee of Casella Waste Systems and Compensation Committee of Vuzix Corporation. •Served as a CEO from 2012-2016 and raised four rounds of capital, helped to build an award-winning technology platform, and scaled the business to serve 300 schools in 9 states. •Prior to that, she served as CEO for two private-equity-backed research firms from 2005-2011: Yankee Group and Cambridge Energy Research Associates (CERA). •She also led consumer technology research at Forrester Research, Inc., where she built the then-largest consumer technology research panel, serving executives at dozens of Fortune 1000 firms seeking to meet consumer needs in a fast-changing technology environment. •She coached over 30 CEOs in the public and private sectors for six years and is a author of ‘‘ANYWHERE: How Global Connectivity is Revolutionizing the Way We Do Business’’ (McGraw-Hill 2010). •Ms. Green received a Bachelor’s degree in linguistics from Georgetown University and a Masters’ degree in Artificial Intelligence and Computer Graphics from the University of Pennsylvania. | ||||

| Age: 66 | |||||

| Trustee since 2018 | |||||

| Independent Trustee | |||||

Committees: Nominating and Governance; Audit | |||||

8

Ola Oyinsan Hixon Ola Oyinsan Hixon | •Executive Director at PGIM Real Estate and portfolio manager on the U.S. Value-Add equity team. •Served as a trustee of the Company since January 23, 2024. •Based in New York, Ms. Hixon is responsible for investment strategy, transactions, asset management, and investor relations primarily for the affordable housing fund strategies and the U.S. Property Fund (USPF) series. •Prior to joining PGIM Real Estate, she was a principal at KKR & Co., with responsibility for portfolio and asset management functions of real estate private equity funds with properties located across the country. •Previously, Ms. Hixon worked at The Blackstone Group where she managed the multifamily portfolio company, LivCor, as well as the single-family home portfolio company, Invitation Homes. Earlier, she worked at the JBG Companies, UBS, and the investment banking division of Citigroup. •Ms. Hixon serves on ULI’s Multifamily Gold Council and is a member of Real Estate Executive Council (REEC). In addition, she serves as a board member of the non-profit City Parks Foundation, which transforms parks into vibrant community centers of urban life for all New Yorkers. •She earned a Bachelor’s degree in business administration from The Stephen M. Ross School of Business at the University of Michigan and a Master’s degree in business administration from The Wharton School of the University of Pennsylvania. | ||||

| Age: 42 | |||||

| Trustee since 2024 | |||||

| Independent Trustee | |||||

Committees: None | |||||

Rodney Jones-Tyson | •Global Chief Human Resource Officer for Baird, a privately held, employee-owned wealth management, asset management, investment banking/capital markets and private equity firm with offices in the United States, Europe and Asia. •Served as a trustee of the Company since January 18, 2022 and is currently chair of the Compensation Committee. •Mr. Jones-Tyson has over 30 years of experience working for global financial services companies. •Prior to his current position, Mr. Jones-Tyson was Baird’s Chief Risk Officer from 2018-2021, the Chief Operating Officer for Baird’s Global Investment Banking Group from 2011-2018 and the Director of Business Development for Baird from 2008-2011. •Mr. Jones-Tyson began his career at Baird in 1998 as an investment banker where he provided mergers and acquisitions and equity capital markets advice to mid-market companies in the US and Europe. •Prior to joining Baird, Mr. Jones-Tyson worked at Chase Manhattan Bank and Citibank. •Mr. Jones-Tyson received his MBA from the University of Chicago Booth School of Business and earned a Bachelor’s degree in Finance from the University of Maryland College Park. | ||||

| Age: 55 | |||||

| Trustee since 2022 | |||||

| Independent Trustee | |||||

Committees: Compensation (Chair) | |||||

9

Anne Olson | •Anne Olson has served as our President and Chief Executive Officer since March 31, 2023. She also has served as Secretary of the Company since April 30, 2017. •Previously, she served as an Executive Vice President and General Counsel of the Company from April 30, 2017 to March 30, 2023 and as Chief Operating Officer from June 25, 2018 until March 30, 2023. •Previously, Ms. Olson was in the private practice of law since 2011, most recently as a partner with Dorsey & Whitney LLP, in the firm’s Real Estate Practice Group, where she focused on real estate development and investments for REITs, private equity funds, and national developers and owners. •Prior to 2011, she served as Director of Investment Operations and in-house counsel for Welsh Companies, LLC and its affiliates, providing leadership in the growth of its asset portfolio and development of a successful capital markets strategy. •Ms. Olson is a member of the National Multi Housing Council Innovation Committee, and a Board Member for CareTrust REIT (NYSE: CTRE). •She holds a Bachelor’s degree in English from Drake University and earned her J.D. with highest honors from Drake University Law School. | ||||

| Age: 47 | |||||

| Trustee since 2023 | |||||

| Executive Trustee | |||||

Committees: None | |||||

Mary J. Twinem | •Former Executive Vice President and Chief Financial Officer of Buffalo Wild Wings, Inc. •Independent director of Valvoline, Inc. (NYSE: VVV) and Medica Holding Company, a multi-state health insurance company. •Served as a trustee of the Company since February 15, 2018 and is currently chair of the Audit Committee and member of the Compensation Committee. •Managed the functional areas of Financial Reporting, Financial Planning and Analysis, Information Systems, Investor Relations, Supply Chain and Philanthropy for Buffalo Wild Wings and its over 1,100 company-owned and franchised Buffalo Wild Wings, PizzaRev, and R Taco restaurants in the United States. In Twinem’s over 20 years with Buffalo Wild Wings, she established the financial framework to grow the company from 35 to over 1,100 restaurants, with system-wide revenue of $3.8 billion in 2016. •She has over 30 years of experience in accounting, financial reporting, and income tax preparation, including seven years in public accounting where she assisted primarily small businesses. •Joined Buffalo Wild Wings as Controller in 1995 and was promoted to Chief Financial Officer in 1996. •She serves on the board of directors of Medica Holdings Company, the non-profit family of companies that include Medica Health Plans and serves as their •She was named to the board of directors and audit committee of Valvoline, Inc., a 150-year old brand that became a NYSE-listed public company in 2016 and serves as their •She | ||||||||||

| Age: 63 | |||||||||||

| Trustee since 2018 | |||||||||||

| Independent Trustee | |||||||||||

Committees: | Audit (Chair), Compensation | ||||||||||

10

| Majority Independent Board | Independent Standing Committees | Regular Access to and Involvement with Management | ||||||||||||||

Only independent trustees serve on | In addition to regular access to management during Board and committee meetings, the independent trustees have ongoing, direct access to members of management and to | |||||||||||||||

| Clawback Policy | Engaged Board | |||||||||||||||

Under the direction of the Board, the Company regularly engages with shareholders on governance, pay, and business matters. | ||||||||||||||||

| No Pledging or Hedging of Shares | Majority Voting with a Resignation Policy | Related Party Transactions | ||||||||||||||

Since inception, vote or to tender resignation if any trustee does not receive a majority vote for such trustee’s election. | ||||||||||||||||

| Risk Assessment | No Interlocking Directorships | Term Limits | ||||||||||||||

The Board conducts an annual risk assessment that focuses on the key risks we face. | No | Trustees are not renominated for election after serving 12 full years on the Board. | ||||||||||||||

| Regular Self-Evaluations | Annual Review of Charters and Key Policies | Separation of Chair and CEO | |||||||||||||||

The Board and its committees conduct annual self-evaluations. | |||||||||||||||||

The Board and each standing committee review | Our governance guidelines provide that the positions of Board Chair and CEO should generally be held by separate persons or the Board will elect an independent lead trustee. The Board is led by an Independent Chair. | |||||||||||

| Environmental | Social Responsibility | ||||||||||

The Nominating & Governance Committee has oversight of our environmental, social and governance (ESG) initiatives. We are committed to creating a diverse, sustainable and environmentally responsible organization. In August 2023, we published our Annual ESG report, which can be found on our website at https://ir.centerspacehomes.com/corporate-overview/corporate-governance/default.aspx | In 2023, we provided $75,710 of financial support to 42 non-profit organizations benefiting the communities in which we operate. During an employee fundraiser in June 2023, our Team Members donated $4,500 to two national charities committed to Diversity, Equity, and Inclusion. We also provided more than 2,600 hours of paid volunteer time to our team members to give back to their communities. Our team members contributed $17,982 to the Team Hope fund that supported 23 of our own team members. | ||||||||||

11

All trustees are expected to attend each meeting of the Board and the committees on which they serve. During 2021,2023, the Board held thirteen meetings, the Audit Committee held five meetings, the Compensation Committee held five meetings, and the Nominating and Governance Committee held seven meetings. NoDuring 2023, all trustee nomineenominees named in the Proxy Statement attended fewer thanat least 75% of the meetings of the Board and the committees on which he or she served, during the past year.except for Ola Oyinsan Hixon, who was not appointed until 2024.

Trustees are not required to attend the Annual Meeting, but the followingall of our Trustees attended the virtual 20212023 Annual Meeting of Shareholders: Mr. Caira, Mr. Decker (CEO), and Ms. Twinem.Shareholders.

Trustee Independence

The Board of Trustees determined that each of John A. Schissel, Jeffrey P. Caira, Michael T. Dance, Emily Nagle Green, Linda J. Hall, Ola Oyinsan Hixon, Rodney Jones-Tyson, and Mary J. Twinem qualified as an “independent trustee” in accordance with the NYSE listing standards (the “Standards”). Under the Standards, no trustee of the Company will qualify as independent unless the Board of Trustees has affirmatively determined that the trustee has no material relationship with the Company, either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company. The Standards specify certain relationships that are deemed to preclude a finding of independence, including, for example, employment by the Company or engaging in certain business dealings with the Company. In making these determinations, the Board reviewed and discussed information provided by the trustees and the Company with regard to each trustee’s business and personal activities as they may relate to the Company and the Company’sour management.

Each member of the Audit Committee qualifies as “independent” under the Standards and the NYSE’s enhanced standards for members of audit committees established by the Securities and Exchange Commission (“SEC”) and the NYSE. Each member of the Compensation Committee qualifies as “independent” under the enhanced standards for members of compensation committees established by the SEC and the NYSE.

Board Leadership Structure

Board Committees

The standing committees help the Board to more effectively direct and review the Company’sour operations and strategic outlook. In addition, the committees allow management to respond timely to factors affecting theour ongoing operations of the Company.operations. Management regularly consults with committee chairs to review possible actions and seek counsel. Where appropriate, the Board delegates authority to committees (within specified parameters) to finalize the execution of various Board functions.

The Board has established the following standing committees: Audit, Compensation, and Nominating and Governance.

12

Audit Committee

The Audit Committee is composed of three trustees, all of whom are independent. Information regarding the functions performed by the Audit Committee is set forth below. The Audit Committee is governed by a written charter that has been approved by both the Audit Committee and the Board.The Audit Committee annually reviews and assesses the adequacy of its charter.charter and recommends any applicable changes to the Board.

The Board has determined that Ms. Twinem, the Chair of the Audit Committee, Mr. Caira and Mr. Dance,Ms. Green, members of the Audit Committee, are all “audit committee financial experts,” as that term is defined in applicable SEC rules.

| Committee | Key Responsibilities | Members | ||||||||||||||

Audit Committee | • | Oversees | Mary J. Twinem (Chair) Jeffrey P. Caira Emily Nagle Green | |||||||||||||

• | ||||||||||||||||

• | Reviews the scope and overall plans for, and results of, the annual audit and internal control over financial reporting. | |||||||||||||||

• | Reviews the responsibilities, staffing, budget, design, implementation, and results of the internal audit function. | |||||||||||||||

• | Consults with management and the independent auditor with respect to | |||||||||||||||

• | Reviews and approves | |||||||||||||||

• | Reviews and discusses with management and the independent auditor quarterly earnings releases prior to their issuance and quarterly reports on Form 10-Q and annual reports on Form 10-K prior to their filing. | |||||||||||||||

• | Reviews with management the scope and effectiveness of | |||||||||||||||

• | Meets regularly with members of | |||||||||||||||

13

Compensation Committee

The Compensation Committee is composed of fourthree trustees, all of whom are independent. Information regarding the functions performed by the Compensation Committee is set forth below. The Compensation Committee is governed by a written charter that has been approved by both the Compensation Committee and the Board. The Compensation Committee annually reviews and assesses the adequacy of its charter.charter and recommends any applicable changes to the Board.

| Committee | Key Responsibilities | Members | ||||||||||||||

Compensation Committee | • | Provides for succession planning for the executive officers, with particular focus on CEO succession. | Rodney Jones-Tyson (Chair) Linda J. Hall Mary J. Twinem | |||||||||||||

• | Oversees the goals and objectives of the Company’s executive compensation plans. | |||||||||||||||

• | Annually evaluates the performance of the CEO, including reviewing, setting, and approving goals and objectives for the CEO and, together with the other independent trustees, determines the CEO’s compensation. | |||||||||||||||

• | Annually reviews and approves the evaluation process for the CEO and the other named executive officers and reviews the CEO’s decisions with respect to compensation of the other executive officers. | |||||||||||||||

• | Makes recommendations to the Board regarding incentive compensation plans, | |||||||||||||||

• | Periodically reviews and approves any employment agreements, severance arrangements, or change in control agreements and provisions for | |||||||||||||||

• | Receives periodic reports on | |||||||||||||||

• | Considers the results of shareholder advisory votes on executive compensation in connection with the review and approval of executive officer compensation. | |||||||||||||||

• | Reviews and discusses the Compensation Discussion & Analysis and Compensation Committee Report with management. | |||||||||||||||

•Reviews and enforces our Clawback Policy. | ||||||||||||||||

• | ||||||||||||||||

Reviews peer groups and criteria for benchmarking used to assess performance and compensation levels for executive | officers. | |||||||||||||||

14

Nominating and Governance Committee

The Nominating and Governance Committee is composed of three trustees, all of whom are independent. Information regarding the functions performed by the Nominating and Governance Committee is set forth below. The Nominating and Governance Committee is governed by a written charter that has been approved by both the Nominating and Governance Committee and the Board. The Nominating and Governance Committee annually reviews and assesses the adequacy of its charter.charter and recommends any applicable changes to the Board.

| Committee | Key Responsibilities | Members | |||||||||||||

Nominating and Governance Committee | • | Plans for Board refreshment and succession planning for directors and identifies, recruits, and interviews candidates to fill positions on the Board. | Jeffrey P. Caira (Chair) Emily N. Green Linda J. Hall | ||||||||||||

• | Identifies and recommends to the Board individuals qualified to serve on the Board. | ||||||||||||||

• | Evaluates incumbent trustees to determine whether to recommend them to the Board as nominees for re-election. | ||||||||||||||

• | Focuses on Board composition and procedures and recommends measures to ensure that the Board reflects the appropriate balance of knowledge, experience, skills, and expertise. | ||||||||||||||

• | Develops and periodically reviews a set of corporate governance principles applicable to the Company and its management. | ||||||||||||||

• | Makes recommendations to the Board regarding the size and criteria for membership on the Board and committees. | ||||||||||||||

• | Oversees a systematic annual evaluation of the Board, committees, and individual directors in an effort to continuously improve the function of the Board. | ||||||||||||||

• | Considers corporate governance matters that may arise and develops appropriate recommendations. | ||||||||||||||

• | Oversees | ||||||||||||||

Trustee Nominations

The Nominating and Governance Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and characteristics of new Board members, as well as the composition of the Board as a whole. This assessment will include members’ independence, as well as consideration of other skills and characteristics that the Nominating and Governance Committee deems appropriate, in the context of the needs of the Board.

In general, candidates for nomination to the Board are either suggested by Board members or Company employees or located by search firms engaged by the Committee. In accordance with the Company’sour Bylaws, the Nominating and Governance Committee will also consider trustee nominations from shareholders. Shareholders who wish to recommend individuals for consideration by the Nominating and Governance Committee to become nominees for election to the Board at an annual shareholder meeting may do so by submitting all the materials required under Article III, Section 6(B) of the Bylaws to the Company’sour Secretary at the following address: Centerspace,

3100 10th St SW, P.O. Box 1988, Minot, ND 58702-1988. Submissions must be received by the Secretary no earlier than the close of business on the 120th day and no later than the close of business on the 90th day prior to the first anniversary of the preceding year’s annual meeting. However, if the Board increases the number of trustees to be elected at an annual

15

meeting but there is nowe do not issue a public announcement by the Trust naming all of the nominees for the increased number at least 100 days prior to the first anniversary of the preceding year’s annual meeting, then submissions, but only with respect to nominees for any new positions created by such increase, will also be considered timely if received by the Secretary no later than the close of business on the 10th day following the day on which such public announcement is first made by the Company. The Nominating and Governance Committee will not alter the manner in which it evaluates candidates, including consideration of the factors set forth in its charter, based on whether the candidate was recommended by a shareholder or was identified by other means.

The charters for the Audit, Compensation, and Nominating and Governance Committees and the Company’sour Governance Guidelines are posted on the Company’sour website at ir.centerspacehomes.com under “Corporate Overview — Corporate Governance.”

Executive Sessions

The Board holds regular executive sessions at which independent trustees meet without Company management or employees present. Executive sessions are held not fewer than four times per year, at each regularly scheduled Board meeting. The Board Chair is the presiding trustee during all executive sessions of the full Board. Committee Chairs preside over executive sessions at the committee level.

Policy Regarding Diversity

Board Role in Risk Oversight

•The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in areas of financial risk, internal controls, and compliance with legal and regulatory requirements. The Audit Committee interacts regularly in executive session with the Company’sour internal and independent auditors in carrying out these functions.

•The Compensation Committee oversees the Company’sour compensation policies and practices to help ensure sound pay practices that do not cause compensation risks to arise that are reasonably likely to have a material adverse effect on the Company.our business.

•The Nominating and Governance Committee assists in oversight of the management of risks associated with Board organization, membership, and structure.

As a critical part of its risk management oversight role, the Board encourages full and open communication between management and the Board. Trustees are free to communicate directly with executive management. Executive management attends the regular meetings of the Board and is available to address any questions or concerns raised by the Board on risk management-related and other matters.

16

The Code of Conduct and Code of Ethics for Senior Financial Officers are posted on the Company’sour website at ir.centerspacehomes.com under “Corporate Governance - Corporate Overview.” The Company intendsWe intend to disclose any future amendments to, or waivers of, the Code of Conduct and the Code of Ethics for Senior Financial Officers on itsour website promptly following the date of any amendment or waiver, or by other method required or permitted under NYSE rules.

Equity Ownership and Retention Policy

Non-Employee Trustees

Under the Company’sour Policy Regarding Share Ownership and Retention, as adopted on September 20.20, 2018 (the(the “Effective Date”) and amended on January 1, 2024, all non-employee trustees are required to own common shares, including shares issued as compensation for Board service, equal to the following:

Required Ownership Multiple of Annual Base Cash Compensation | |||||||||

Non-Employee Trustees | 5x | ||||||||

Trustees are required to satisfy the ownership guidelines within five years following the later of (1) the Effective Date or (2) the date the Trustee was first elected or appointed to the Board. Once the Company certifieswe certify that a trustee has met the ownership requirement, future declines in common share value will not impact compliance as long as the trustee continues to own at least the same number of shares the trustee owned at the time the trustee achieved the required ownership level. In addition, trustees are required to retain at least 60% of the shares received as a result of any equity awards grantedwe grant as compensation to the trustee by the Company until such time as the trustee is no longer a trusteeone of the Company.our trustees. The status of share ownership and retention is reviewed annually by the Compensation Committee to ensure compliance.

17

Ownership includes:

•shares owned directly by the participant, participant’s spouse, and/or children;

•shares held in a revocable trust for the benefit of the participant, participant’s spouse, and/or children;

•shares owned by an entity in which the participant has or shares the power to vote or dispose of the shares;

•shares held in a retirement account owned by the participant or participant’s spouse; and

•shares pursuant to an equity award that are to vest within 12 months.

Shares do not include shares pursuant to performance awards that have not yet been earned. The Company intendsWe intend that equity awards granted by the Companywe grant under itsour equity compensation plans will satisfy the ownership requirements.

Officers

The Policy Regarding Share Ownership and Retention also applies to the Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, any other executive vice presidents, any senior vice presidents,Executive Vice Presidents, and any vice presidentsSenior Vice Presidents of the Company. As perPer the policy amended December 9, 2021,January 1, 2024 all Officers are required to own our common shares and preferred shares of the Company and stock options grantedwe grant within the Company’sour Long-Term Incentive Plan (LTIP). The ownership requirements are as follows:

| Required Ownership Multiple of Base Salary | |||||||||

Chief Executive Officer | 5x | ||||||||

Chief Financial Officer & Chief Operating Officer | 2x | ||||||||

Other Executive Vice Presidents | 2x | ||||||||

Senior Vice Presidents | |||||||||

0.5x | |||||||||

Officers are required to satisfy the ownership guidelines within five years following the later of (1) the Effective Date or (2) the date the officer was first appointed or hired as an officer. Promotion to a new office resets the five-year period. Once the Company certifieswe certify that an officer has met the ownership requirement, future declines in common share value will not impact compliance as long as the officer continues to own at least the same number of shares the officer had when they achieved the required ownership level. In addition, officers are required to retain at least 60% of the net shares received as a result of any equity awards grantedwe grant to the officer issued to them by the Company until the ownership requirement is reached, the officer ceases to be an applicable officer, or the officer ceases to be employed by the Company,us, whichever occurs first. For purposes of this policy, “net shares” are those vested shares that remain after shares are sold or withheld, as the case may be, to pay any applicable exercise price for the award and to satisfy any tax obligations arising in connection with the exercise, vesting, or payment of the award.

Ownership includes:

•shares owned directly by the participant, participant’s spouse, and/or children;

•shares held in a revocable trust for the benefit of the participant, participant’s spouse, and/or children;

•shares owned by an entity in which the participant has or shares the power to vote or dispose of the shares;

•shares held in a retirement account owned by the participant or participant’s spouse; and

•shares pursuant to an award that are to vest within 12 months and unvested and unexercised stock options granted to Officers through the LTIP.

18

Shares do not include shares pursuant to performance awards that have not yet been earned, and unexercised share options that were not granted to the Officers through the LTIP, and unvested stock options granted through the LTIP. The Company intendsWe intend that equity awards granted by the Companywe grant under itsour equity compensation plans will satisfy the ownership requirements.

Failure to comply with this policy may result in the requirement that the officer retain 100% of net shares received as a result of any equity awards granted by the Companywe grant until the officer has reached the required ownership level. The CompanyWe may grant waivers of these requirements where compliance would place a severe hardship on an officer, would prevent an officer from complying with a court order, or in other exceptional circumstances. The status of share ownership and retention is reviewed annually by the Compensation Committee to ensure compliance.

Complaint Procedure

The Sarbanes-Oxley Act of 2002 requires companies to maintain procedures to receive, retain, and treat complaints received regarding accounting, internal accounting controls, or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Company’sOur Audit Committee has adopted a complaint procedure that requires the Companyus to forward to the Audit Committee any complaints that it has receivedwe receive regarding financial statement disclosures, accounting, internal accounting controls, or auditing matters. Any employee of the Companyour employees may submit, on a confidential, anonymous basis if the employee so chooses any concerns on accounting, internal accounting controls, auditing matters, or violations of the Company’sour Code of Conduct or Code of Ethics for Senior Financial Officers. All such employee concerns may be reported by means of the Company’sour whistleblower hotline through Lighthouse Services, an independent provider that assists organizations to identify improper activity or submitted in a sealed envelope to the Chair of the Audit Committee, in care of the Company’s General Counsel, who will forward any such envelopes promptly and unopened. The Audit Committee will investigate any such complaints submitted.

Communications to the Board

The Board recommends that shareholders and other interested parties initiate any communications with the Board in writing. Shareholders and other interested parties may send written communications tothe full Board, the non-management trustees, any of the Committees, the Chair, or to any individual trustee c/o the Secretary, Centerspace, 3100 10th St SW, P.O. Box 1988, Minot, ND 58702-1988, or via e-mail to trustees@centerspacehomes.com. All communications will be compiled by the Secretary and forwarded to the Board, the specified Board committee, or to individual trustees, as the case may be, not less frequently than monthly. This centralized process will assist the Board in reviewing and responding to communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication.

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Related Party Transactions Policy